The predictive power of web scraped product data for institutional investors: A GoPro case study

Investors understand the importance of high-quality information. It minimizes risk, empowers decision-making, and enables investors of all sizes to obtain alpha - like the old adage, knowing is often half the battle.

Knowing this, alternative data providers wield vast, untraditional datasets derived from hundreds of millions of sources, not only enabling asset managers to consistently obtain alpha but granting them a competitive foresight that makes access to such data so highly desirable.

Truer still, traditional data channels simply cannot produce the same actionable insights as alternative data. The rise of big data and advanced machine learning technologies in the past decade speaks to the critical nature of information and to the strange reality that now faces us: we can parse it with extreme efficiency, but we need more of it and from more sources.

But how do investors use alt data to inform their business decisions?

In October 2015, Eagle Alpha, a provider of alternative financial data, published a report on action camera manufacturer GoPro (NASDAQ: GPRO). Using data aggregated from US electronics websites and more than 80 million sources, the company’s publication highlighted weaknesses in GoPro’s revenue for the third quarter of that year, signaled by weak demand for GoPro products and a negative mix shift towards lower-end products. While 68% of stock recommendations insisted investors buy, Eagle Alpha predicted otherwise, correctly observing that the company would miss its Q3 targets.

They were right. How?

It wasn’t intuition, but better data, and a lot more of it. When it comes to alternative data, data quality is everything. The existence of “Return on Data” as a term used by asset managers and Chief Data Officers is itself telling: investment research is paradigmatically transforming towards better utilization of data and with tremendous potential. If competitors rely solely upon traditional data, those using alternative data are capable of seeing around corners, assessing risk, and determining optimal stock positions based on information unknown to others.

GoPro is a particularly interesting example, given its former status as a stock market darling - a company whose stocks soared to an all-time high of $98.47 on October 14. From its IPO in June 2014, the stocks rose sharply promoting investor confidence and expectations of strong revenue growth for a company innovating cameras, drones, and aspiring to be a lifestyle media company.

Disappointing Q3 2015 results pointed to the weakness of traditional analysts’ methods of anticipating a company’s performance. GoPro reported Q3 earnings of $400 million, falling $30 million short of the $430 million expected. The company projected a Q4 between $500-550 million, which is 17% lower YoY. Part of the reason alternative data, in particular web scraped pricing data, was ahead of the curve is the fact GoPro’s pricing adjustment of the Hero 4 from $399 to $299 likely negatively impacted sales. Why buy a product or buy a company’s new release if you think the company will adjust its price by an astounding 33%?

In the Q3 earnings call, CEO Nicholas Woodman remarked “While we experienced strong year-over-year growth, this quarter marks the first time as a publicly-traded company that we delivered results below the expectations that we outlined in our guidance”(Source). One of the factors Woodman pointed to for the weak Q3 performance was the price adjustment of the Hero 4 to $299 that was in response to the camera’s underperformance. This adjustment resulted in “$19 million of price protection.”

The earnings call closely mirrors Eagle Alpha’s own proactive outlook on GoPro’s pricing mistakes and weakening demand for these higher-priced models in the face of lower-priced competition. The key here is alternative pricing data gives investors the leg up against those using earnings reports as their investing GPS, so to speak.

As online retail burgeons to record highs, what better place to look for consumer sentiment than data from online retail giants like Amazon and Best Buy? Amazon was responsible for 44% of all U.S e-commerce sales in 2017 (CNBC). Taking advantage of key metrics like average selling price, quantities sold in a given month, and frequency of price drops gives an investor much more insight into the competitive landscape of industry like adventure cameras.

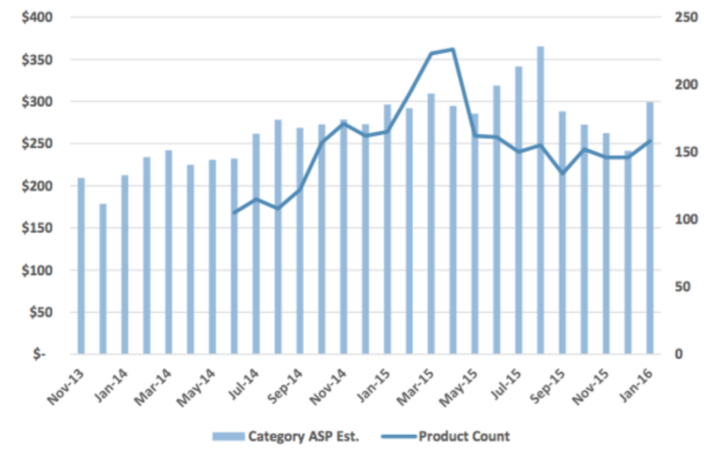

While the competitive landscape and average selling price for adventure cameras transformed, so did GoPro’s fate. Extracting average selling price (ASP) and consumer interest from web crawling on electronics websites is key to how alternative data providers stay one step ahead of those relying on traditional data. For example, web scraped product data below shows hows ASP fell as market saturation rose - a combination that can dethrone companies that were once at the helm of their respective industries.

Average selling price spiked in Q4 2014 and early 2015, and companies like GoPro with high-end adventure cameras hit record high stock prices and investor sentiment continued to strengthen. As we can see, from this period of November 2014 - Mar 15, ASP continued to rise while product count stayed relatively steady. Identifying this pattern of market saturation is a key way in which alternative data investors can see risk before traditional data flags a company.

Source Eagle Alpha.

Data history is everything

To asset managers, missing a trend is likely missing the boat on an opportunity for alpha. From Q4 2013 to Q4 2015, the wearable action camera market experienced a price segmentation convergence, where the low, mid, and high-end price segments eventually collapsed on themselves.

Using sophisticated web scraping technology to aggregate and index millions of points of information from across the web, Eagle Alpha was able to capture valuable insight into consumer preferences and, unfortunately for GoPro, a decreasing interest and average selling price (ASP) for wearable action cameras.

GoPro tried to focus on entry-level products as the compression of mid-range and higher-end products intensified, but this strategy ignored other critical issues within the market, namely that overall demand was diminishing and average selling price trends were highly negative. The company has struggled to make a comeback.

Quantity and quality: Not mutually exclusive

Scraping price data from almost a hundred million sources enables alternative data providers to provide strong directional indicators for a number of measurements related to a company’s overall health and success. Web scraped product data is an especially powerful tool for predicting company fundamentals and is thus extremely useful in the investment decision-making process. It’s also extremely useful to business owners, executives, and key decision-makers, as it informs strategic decisions that enable more intelligent and shorter sales cycles, competitive advantages, improved revenue per customer, and heightened internal operational efficiency to name a few.

Incomplete or low-quality data, on the other hand, pose a legitimate risk to investors as it skews or modifies interpretations that could otherwise lead to profitable outcomes. In traditional investment research, missing data or misrepresentative data is often a dead-end without highly specialized tools and access. Alternative data providers, like Eagle Alpha and Zyte , put a premium on data quality and employ sophisticated crawling algorithms to ensure the capture and verification of all available past and present information - it’s one thing to ensure data quality with a moderate amount of information, and another thing entirely to mandate quality when working with hundreds of millions of points of information. Leveraging world-class technology with expert crawl engineers and data scientists, alternative data providers, are able to predict the success or failure of product launches and actually determine public sentiment toward a particular brand or iteration.

Crawling product data

Price data extracted from the web and major retailers was key in predictions of GoPro’s weakening performance for Q3 2015. Observations of lower demand and average sales price from third-party retailers like Amazon, Best Buy, and other major retailers give hedge funds and wall street traders the ability to better forecast how a company or product’s pricing is shaping revenue in real-time.

By utilizing the broad spectrum of pricing information available on the web, investors making use of alternative financial data are able to see the Average Selling Price fluctuations before the company itself expresses concerns or releases negative earnings reports. Aggregated pricing data is more readily available than it was in the past, providing more current corporate revenue and insight into industry competition.

Today, GoPro faces mounting competition and struggles to find a way to bounce back from its peak in 2014 and early 2015. Amazon and other retailers show how lower-priced alternatives often edge out GoPro.

If you’d like to see the underlying data for Eagle Alpha’s GoPro prediction, or any of the other 40 sample alternative data use cases then be sure to check out their 124-page report: Alternative Data Use Cases Report.

Looking forward to 2019, projected spending on alternative data and web scraped pricing information is higher than ever before. As hedge funds and investment firms purchase more alternative data, the key to staying ahead of the curve is going to be knowing how to use this data.

If you’d like to believe there is the alpha in web data and would like to incorporate it into your investment decision-making process, then be sure to reach out to Zyte's Solution Architecture team for a free consultation. We provide web data to numerous hedge funds, investment banks, and alternative data providers so our team can help you architect a solution for you to get the web data you need.